Copper Market Rallies on Clean-Energy Demand as EVs and renewables fuel record expansion. Discover 7 insights on demand, price forecasts, and global trends.

Table of Contents

- Introduction

- Why the Copper Market Rallies on Clean-Energy Demand

- Copper and the Electric Vehicle Revolution

- Renewable Energy Infrastructure’s Copper Hunger

- Copper Market Rallies on Clean-Energy Demand: Price Projections

- Geopolitical and Supply Chain Challenges

- Recycling and Circular Copper Economy

- Key Global Players Shaping the Copper Market

- India’s Role in the Global Copper Landscape

- Conclusion

1. Introduction

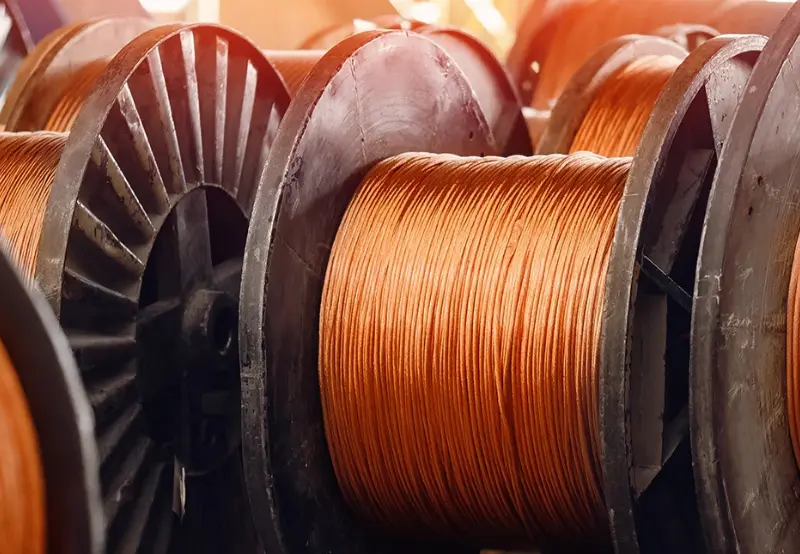

The Copper Market Rallies on Clean-Energy Demand, reaching unprecedented heights as the world shifts towards sustainability. Projections show copper demand surging to nearly $340 billion by 2030, fuelled by electric vehicles (EVs), renewable power infrastructure, and grid modernisation.

BloombergNEF anticipates a 20% price rise by 2027, highlighting copper’s central role in the clean-energy revolution.

2. Why the Copper Market Rallies on Clean-Energy Demand

Copper is the backbone of electrification. Its high conductivity and durability make it essential for:

- EV motors and batteries

- Solar panels and wind turbines

- Smart grids and charging stations

As governments intensify decarbonisation, demand for copper has surged, positioning it as the “green metal” of the future.

3. Copper and the Electric Vehicle Revolution

The EV industry alone is transforming copper markets:

- Traditional vehicles use ~20 kg of copper.

- EVs require 80–100 kg, a 4–5x increase.

- By 2030, EVs could account for 10 million tonnes of annual copper demand.

This explosive growth cements why the Copper Market Rallies on Clean-Energy Demand globally.

4. Renewable Energy Infrastructure’s Copper Hunger

Renewables also rely heavily on copper:

- Wind turbines: up to 4 tonnes per unit.

- Solar farms: require kilometres of copper wiring.

- Energy storage and transmission lines: add further demand.

With solar and wind capacity projected to double by 2030, copper remains at the core of renewable expansion.

5. Copper Market Rallies on Clean-Energy Demand: Price Projections

BloombergNEF forecasts a 20% rise in copper prices by 2027. Factors influencing this include:

- Demand from EV and renewable industries

- Supply chain disruptions

- Rising energy costs in mining

Analysts suggest prices could cross $12,000 per tonne, making copper one of the most sought-after commodities in the clean-energy era.

6. Geopolitical and Supply Chain Challenges

Copper mining is geographically concentrated, with Chile, Peru, and China dominating production. This raises risks of:

- Political instability

- Export restrictions

- Logistics disruptions

These vulnerabilities could push prices higher and intensify global competition.

7. Recycling and Circular Copper Economy

To balance demand, recycling will play a crucial role:

- Recycled copper already meets 30–35% of global supply.

- Circular economy initiatives can reduce mining dependence.

- Urban mining—recovering copper from old electronics—offers vast potential.

The copper market’s sustainability depends on scaling recycling technologies.

8. Key Global Players Shaping the Copper Market

Industry leaders include:

- Codelco (Chile)

- Freeport-McMoRan (USA)

- Glencore (Switzerland)

- Hindustan Copper (India)

Their investments in green mining and supply chain resilience will define future market stability

🇮🇳 9. India’s Role in the Global Copper Landscape

India is emerging as a key copper consumer due to:

- Rapid EV adoption

- Ambitious solar and wind targets

- Grid modernisation

Domestic companies like Hindustan Copper and Vedanta are expanding production, while imports fill the gap. India’s demand could double by 2030, reshaping trade flows.

10. Conclusion

The phrase “Copper Market Rallies on Clean-Energy Demand” isn’t a temporary trend—it’s the new reality. From EVs to renewable power, copper is at the heart of global decarbonisation.

With prices projected to surge and demand skyrocketing, copper has become the undisputed green commodity of the decade.